nj bait tax example

3246 or bill establishing the business alternative income tax BAIT an elective New Jersey. The BAIT is intended to give NJ individual income taxpayers a work-around of the.

Dental Insurance 101 In 2022 Dental Insurance Plans Dental Insurance Dental Coverage

The owners then receive a proportionate credit on their New Jersey gross income tax liability.

. The 2021 PTE-200-T Extension of Time to File grants a six-month extension to September 15 2022. Monday May 16 2022. Pass-Through Business Alternative Income Tax Act.

Finally we add the 63087 base to the 10900 tax to obtain the elective entity tax. This date is not extended. When Governor Murphy signed the Pass-Through Business Alternative Income Tax BAIT into law.

Nj bait tax example. On January 13 2020 Governor Phil Murphy signed into law Senate Bill 3246 S. Based on the information in the examples.

Rather in that state an electing PTE can instead elect to be treated as a C corporation solely for Wisconsin income tax purposes and. By passing through a net amount of income reduced by the SALT deduction the owner is able to fully deduct their New Jersey taxes for federal purposes. Pass-Through Business Alternative Income Tax Act.

Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. NJ Business Alternative Income Tax BAIT By Michael Brown CPA. For example in 2018 and 2019 a taxpayer paying 15000 in property taxes on their New Jersey home and 20000 in state income tax would have been limited to an overall.

Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a federal income and allocated the three ways 8639417. The BAIT is an elective tax regime effective for tax years beginning on or after January 1 2020 whereby qualifying pass-through business entities may elect to pay tax at the. Mechanics of the BAIT Election.

The PTEs distributive income is subject to tax at the following graduated rates for purposes of computing the BAIT. Returns due between March 15 2022 and June 15 2022 are due by June 15 2022This includes the 2021 PTE Election 2021 PTE-100 Tax Returns 2021 PTE. 1418750 plus 652 for distributive proceeds between 250000 and 1000000.

The New Jersey pass-through entity tax took effect Jan. For New Jersey tax purposes income and losses of a pass. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal.

For the 2020 tax year the four tiers of income tax rates are as follows. Wisconsin did not enact a brand-new tax. PL2019 c320 enacted the Pass-Through.

63087 10900 1100000 1000000 100000 x 109 10900 73987. Regardless of its participation in the BAIT a firm organized as a PTE must continue to withhold tax on the non-resident owners New Jersey income.

Full Article We Re Just Here Working On A Story First Amendment Auditors Political Culture And The Mediated Public Sphere

Are There Any Examples Of Real World Applications Of Cooperative Game Theory In Business Quora

Negotiating Realtor Fees 10 Tips For Reducing Commission

Nj Bait And New Salt Guidance What You Need To Know Smolin

Dark Patterns Past Present And Future

Genome Wide Identification Of The Cytochrome P450 Superfamily In Olea Europaea Helps Elucidate The Synthesis Pathway Of Oleuropein To Improve The Quality Of Olive Oil Sciencedirect

Sustainability Free Full Text The Mediating Role Of Eco Friendly Artwork For Urban Hotels To Attract Environmental Educated Consumers Html

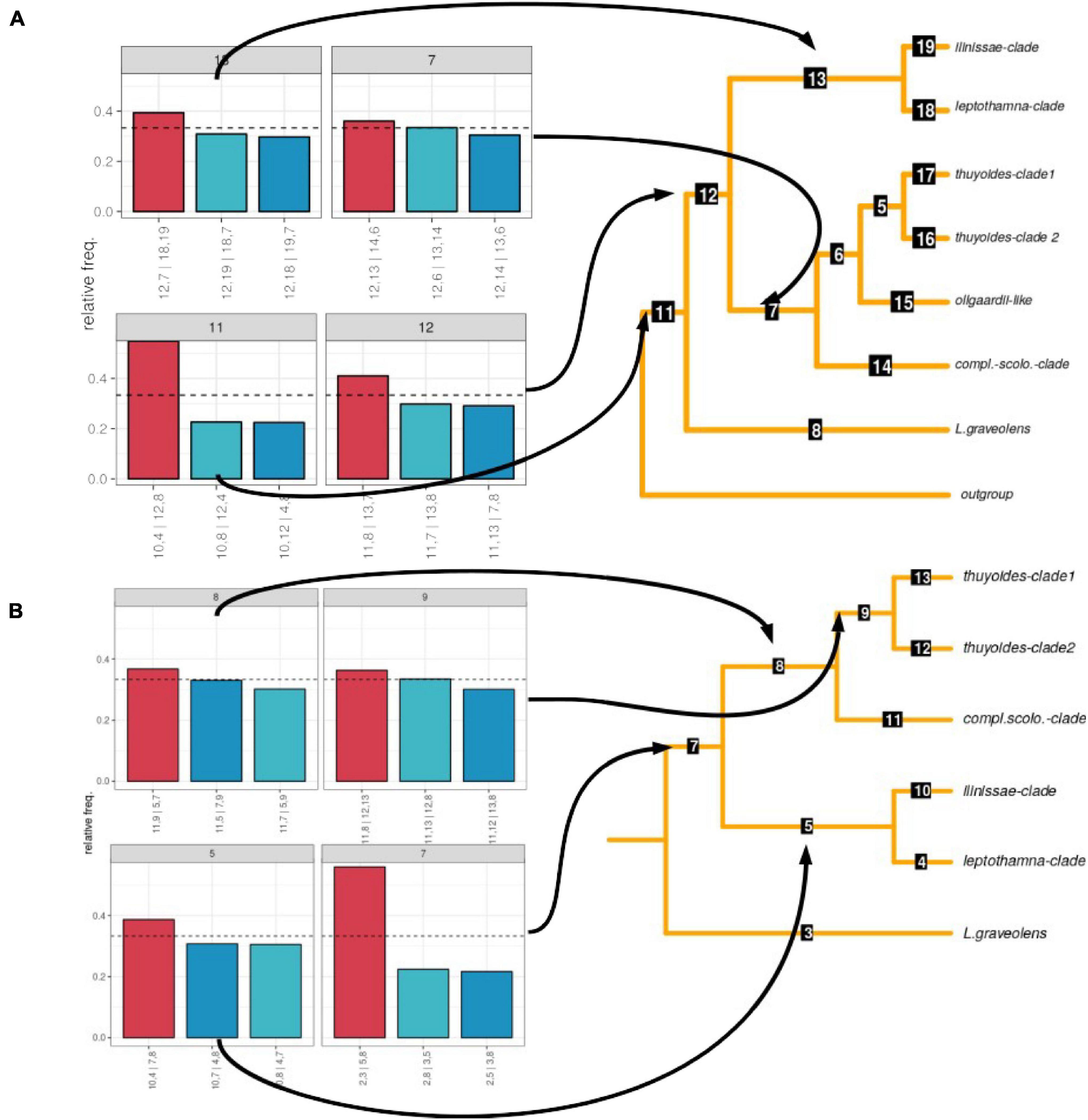

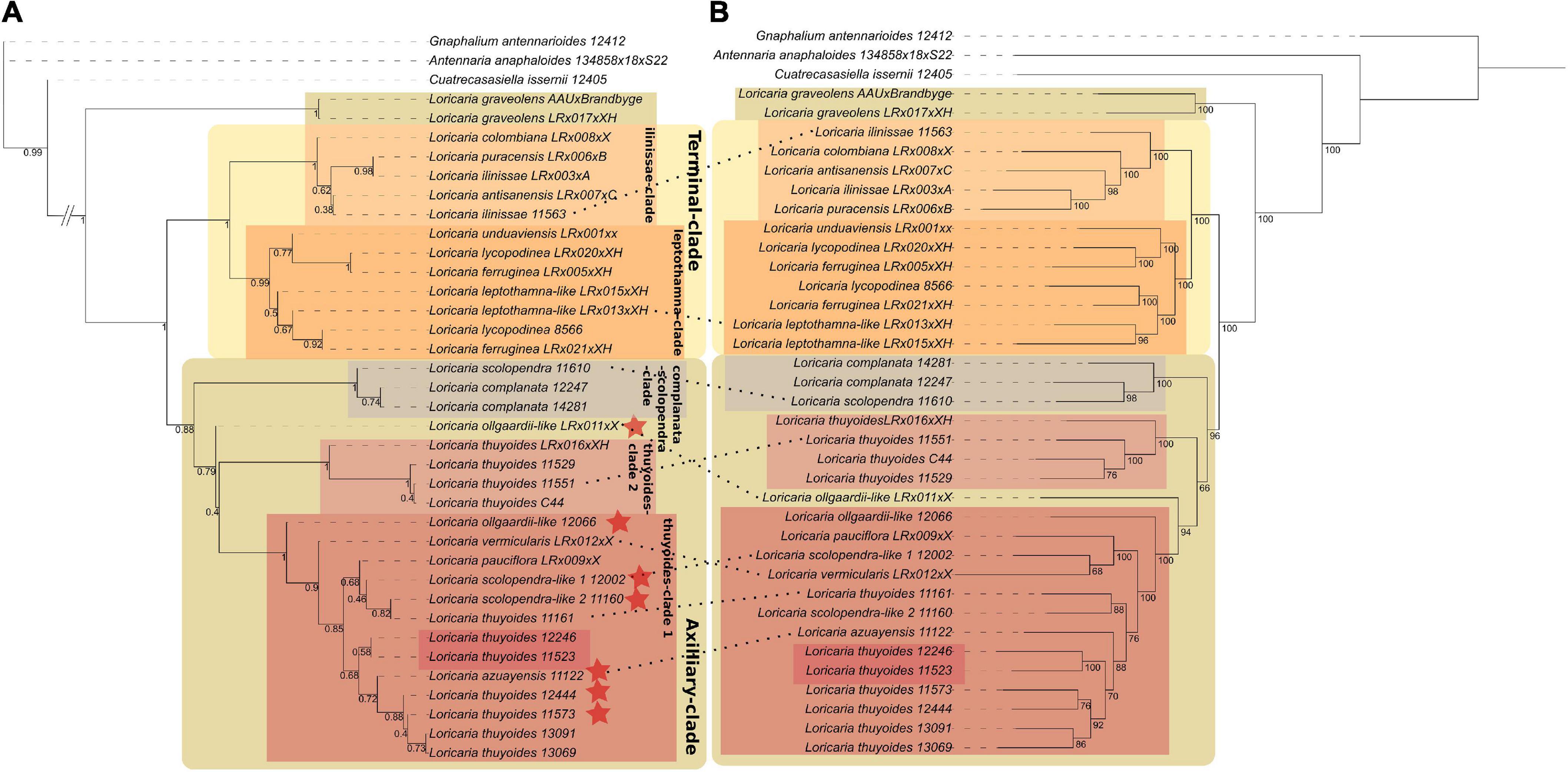

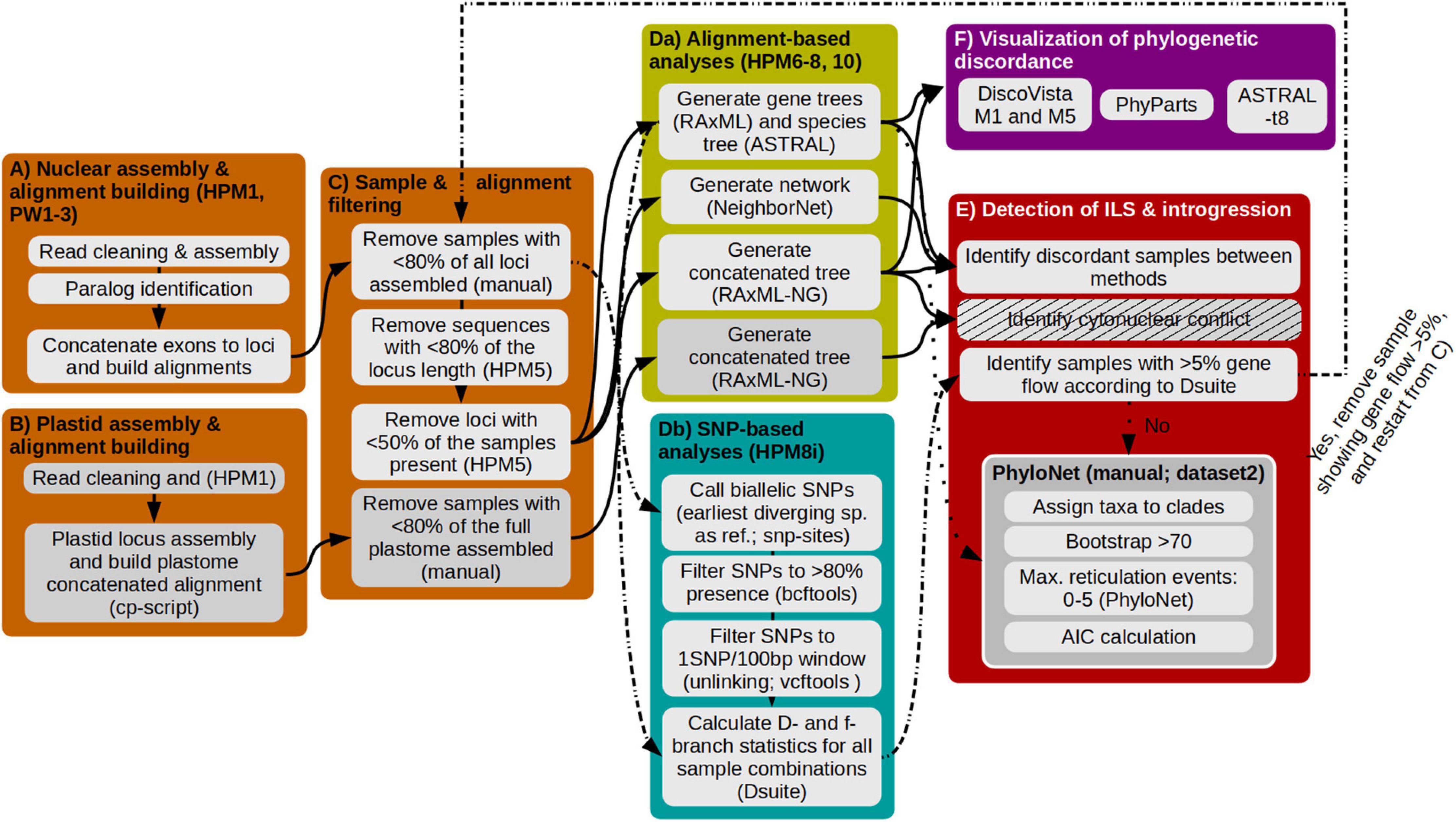

Frontiers How To Tackle Phylogenetic Discordance In Recent And Rapidly Radiating Groups Developing A Workflow Using Loricaria Asteraceae As An Example

Frontiers How To Tackle Phylogenetic Discordance In Recent And Rapidly Radiating Groups Developing A Workflow Using Loricaria Asteraceae As An Example

Frontiers How To Tackle Phylogenetic Discordance In Recent And Rapidly Radiating Groups Developing A Workflow Using Loricaria Asteraceae As An Example

Good News Bad News Is The New York Entity Tax Election Worthwhile Marks Paneth

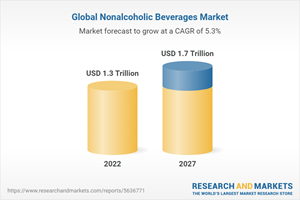

Global Nonalcoholic Beverages Market Analysis Report 2022 2027 Featuring Leading Players Ambev Coca Cola Carlsberg Hershey Kraft Heinz Kerry Group Monster Beverage And Royal Dsm